Standard options allow the owner the right, but not the duty, to purchase or sell the underlying assets at a certain price at a later date. DeFi options offer the same, except they run on decentralized exchanges and do not require an intermediary.

Options are among the most common financial products in the world, with 54 billion options contracts exchanged in 2022. At the same time, traditional options trading is opaque and not for everyone, and decentralized finance (DeFi) is changing that.

Note that options trading is much more popular in the USA than in Europe. The reason behind that is that contracts for difference (CFDs) are banned in the USA, while they’re widely offered by brokers in Europe.

If you’re wondering about the practicals of options trading on DeFi, you’re in the right place. Keep reading to learn more about this interesting financial instrument that’s finally within everyone’s reach.

This guide delves into the world of DeFi derivatives, a rapidly evolving sector in decentralized finance.

Options trading may look completely different depending on your geographical location. You should also take differences between American- and European-style options into account.

Owners of American-style options, for example, may exercise at any time before the option expires. European-style options, on the other hand, can be exercised only after they expire. Although the vast majority of stock options are of the American variety, several broad-based equity indexes, including the S&P 500, feature actively traded European-style options.

Then there are differences around contracts for difference (CFDs).

Why are CFDs illegal in the United States? Partly because it’s an over-the-counter (OTC) product, which means it doesn’t transit through authorized exchanges. Leverage also increases the likelihood of higher losses, which authorities are concerned about.

The European Securities and Markets Authority (ESMA) has adopted extensive regulations governing the sale of contracts for difference (CFDs) and binary options to retail investors.

The Ethereum blockchain is the most popular network for option protocols. There are now four blockchain-based decentralized applications (dApps) with millions of dollars in total value locked (TVL):

Lyra is an options Automated Market Maker (AMM) that allows users to purchase and sell options against a liquidity pool. Lyra's main user groups are liquidity providers and option traders. Funds are deposited into one of Lyra's Market Maker Vaults by liquidity providers. Traders can purchase or sell options to the Vaults in exchange for a fee paid to liquidity providers.

Dopex is an decentralized options exchange and trading protocol that allows users to buy and sell options in a capital-efficient and streamlined manner by utilizing option pools. The platform provides liquidity for customers through vaults, with liquidity providers receiving a passive income in the process.

Opyn promises to be a capital-efficient DeFi options trading protocol that has low fees and offers free limit orders to its customers using an on-chain settlement architecture. This platform developed one of the earliest DeFi options trading protocols and introduced Opyn Squeeth, the world's first perpetual option.

Hegic is an Arbitrum AMM for trading options. It uses a Stake & Cover pool to offer liquidity, in which LP members share the protocol users' profit or loss.

An options contract grants an investor the right to purchase or sell the underlying assets at a certain price before the contract expires. This complexity arises from the nature of the underlying assets and their market behavior. A futures contract, on the other hand, compels a buyer to buy the underlying investment or commodity and a seller to buy or sell it on a particular future date, unless the holder's position is closed sooner.

Investors can use financial derivatives such derivative contracts such as options and futures to speculate on market price movements or hedge risk. Both options and more traditional futures contracts can let an investor buy an investment at a predetermined price and date. However, the regulations governing options and futures contracts differ significantly, as do the dangers they bring to investors.

Options contracts are risky because they’re quite sophisticated. The cost or premium of a stock option determines this risk. In the worst-case scenario, if the options expire worthless, the option premium paid will be a complete loss.

Selling a put option, on the other hand, exposes the seller to a loss that might be considerably greater than the premium obtained from a hypothetical drop in the value of the shares underlying the stock option. If a put option grants the buyer the right to sell the stock at $50 per share but the stock falls to $10, the seller is still obligated to acquire the shares at $50 per share.

The risk to the option buyer is confined to the premium paid up front. The price of an option varies depending on a variety of factors, including how distant the strike price is from the current price of the underlying securities and how much time remains until expiration. This premium is given to the put option seller, also known as the option writer.

Options on futures are dangerous, but perpetual futures contracts are far riskier for the individual investor. Both the buyer and seller are bound by futures contracts. Futures positions are marked to market on a daily basis, and when the price of the underlying instrument changes, the buyer or seller may be required to post more margin.

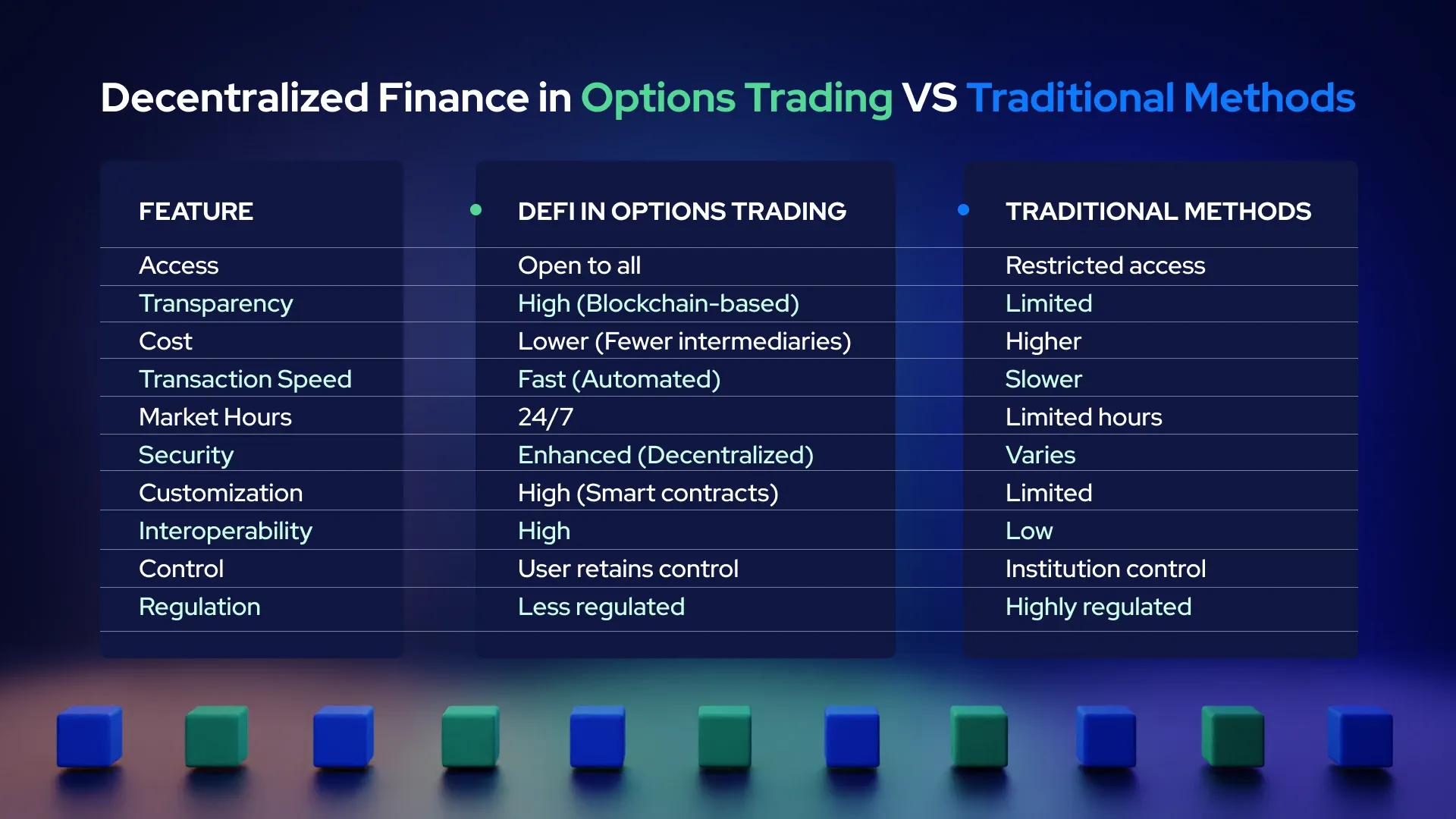

In decentralized finance and crypto derivatives, a public blockchain serves as the trust source and controls all financial processes. In contrast, public governance in traditional derivatives, which includes regulations and regulated financial institutions, serves as the source of trust, controlling all traditional finance activities.

Decentralized finance is gaining popularity because it’s more open and transparent than traditional financial services market. Because there are no entry restrictions, anybody with programming skills may participate in developing financial services and products on top of public blockchains.

In contrast, high entrance barriers have made it unlikely that the old financial system will welcome the rising trend. The requirement to secure relevant licenses and approvals from authorities has stifled innovation in traditional banking systems.

By providing services that aren’t regulated by any central authority, such as banks or financial organizations, DeFi has revolutionized the old financial system.

Smart contracts, which are self-executing contracts with the contents of the agreement directly put into code, ease transactions. This not only cuts costs and boosts efficiency, but it also democratizes the financial system by allowing anybody, regardless of geography or financial standing, to make, execute, and approve transactions.

Another significant advantage is greater security and privacy. Transactions are transparent and auditable since DeFi apps are built on blockchain technology. This lowers the likelihood of fraud and corruption. Furthermore, because transactions are peer-to-peer, users have complete ownership over their digital assets and personal information, as opposed to traditional financial systems in which banks and other entities keep and manage user data.

DeFi transactions are also more efficient and faster. Traditional banking systems can include extensive processes and intermediaries, which can cause transactions to be delayed. DeFi, on the other hand, runs around the clock, allowing for rapid, smooth transactions. This is especially useful for cross-border transactions, which may be time-consuming and costly in the traditional banking system.

These are strategies that aim to achieve a profit from the expected price movement of the underlying instrument.

This is about buying a call option when the investor expects the price of the underlying instrument to increase. Buying a near term option gives the investor the right to purchase the underlying asset at a specific price on a specific date. This strategy is used when the investor expects the price of the underlying asset to increase.

Buying a put option when the investor expects the price of the underlying instrument to decline. Buying an expiration option gives the investor the right to sell the underlying asset at a specified price on a specified date. Investors use this strategy when they expect the price of the underlying asset to decline.

Selling a call option when the investor expects a decline in the price of the underlying instrument. Selling a near term option gives the investor an obligation to deliver the underlying asset at a specified price by a specified date. This strategy is used when the investor expects the price of the underlying asset to stabilize or decline.

Selling put options when the investor expects the price of the underlying instrument to increase. Selling an expiration option gives the investor an obligation to purchase the underlying asset at a specified price on a specified date. Investors use this strategy when they expect the price of the underlying asset to be stable or the current market price to increase.

These are strategies whose aim is to protect the portfolio against unfavorable movements in the price of derivatives or the underlying instrument. Investors use options to hedge their existing positions in the underlying market itself, reducing the risk of loss due to unfavorable price movements.

Here’s a list of hedging strategies:

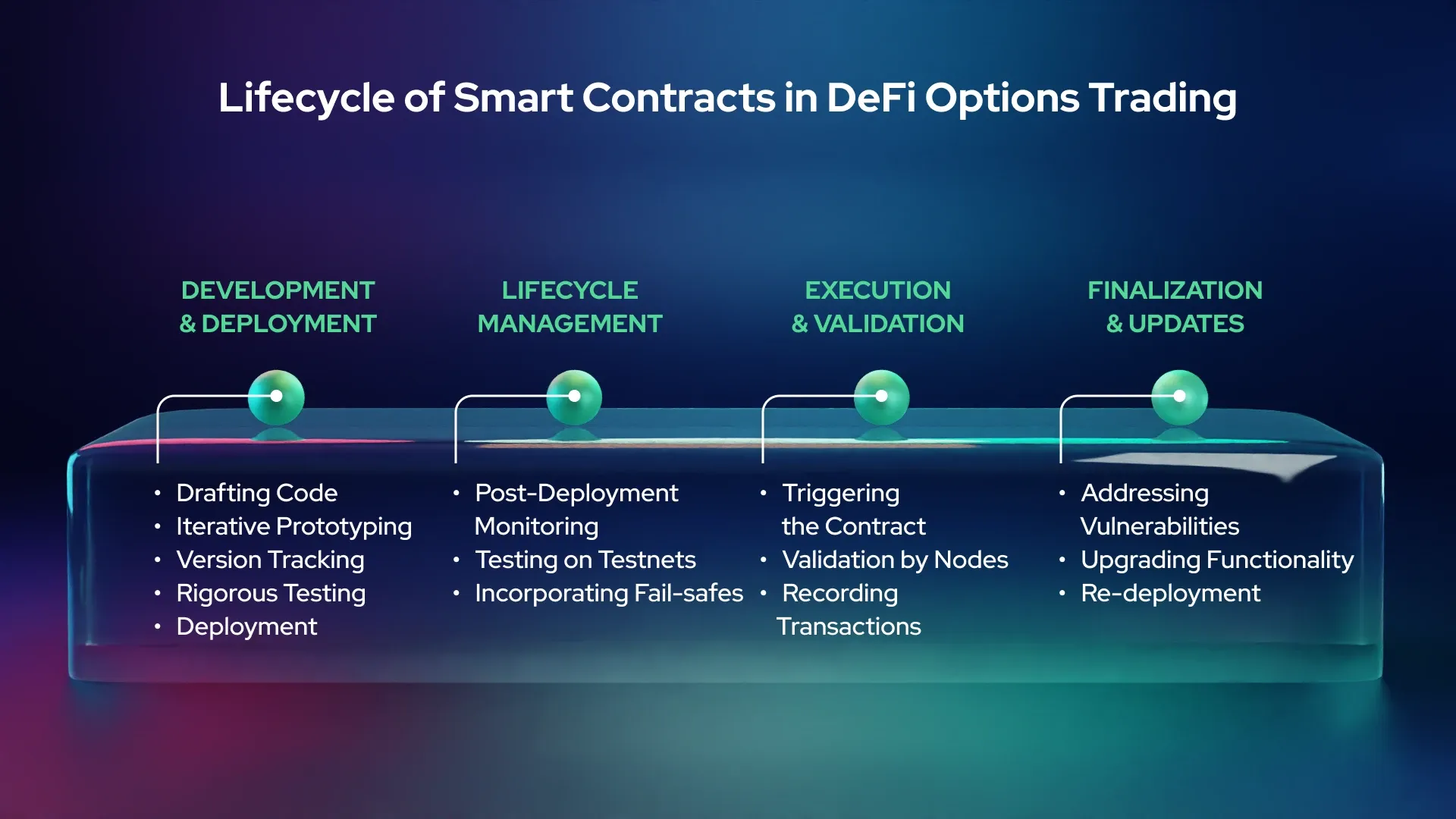

In the dynamic world of DeFi (Decentralized Finance), smart contracts have revolutionized the way we look at financial instruments, particularly in the realm of derivatives trading. The lifecycle of smart contracts in options trading stands as a testament to this evolution, moving beyond the scope of standard contracts to cater specifically to the nuanced demands of financial derivatives.

Each options contract, with its own set of expiry terms – be it daily, monthly, or quarterly – is represented by a bespoke smart contract. This specific approach ensures a perfect alignment between the contract's terms and its trading period. The development and deployment of these contracts are meticulously tailored, reflecting the distinct nature of each series. This level of customization is crucial in an environment where precision and accuracy are paramount.

Once deployed, these contracts are not static. They are continuously managed and integrated with essential auxiliary services, such as Price Oracles. These oracles play a pivotal role in ensuring fair and accurate settlements of contracts based on real-time market prices. This integration is vital, bridging the gap between the blockchain-based contracts and the ever-fluctuating financial market realities.

The emphasis in this lifecycle is not merely on executing blockchain transactions but on the actual settlement of derivative instruments. When an options contract reaches its conditions, the smart contract doesn't just process transactions; it orchestrates the settlement process according to the predefined rules. This stage is critical in guaranteeing that the financial obligations of the contract are met with precision.

Finally, the lifecycle includes the crucial phase of adaptation. The financial world is not static; it's a landscape constantly shaped by market forces and regulatory changes. Smart contracts in this realm, therefore, need the flexibility to evolve. Developers might terminate an existing contract to address new market conditions or regulatory requirements, subsequently deploying a new version. This adaptability is key to maintaining relevance and compliance in a rapidly changing financial world.

In summary, the lifecycle of smart contracts in DeFi options trading is a nuanced and dynamic process. It's a process that goes beyond code, intertwining with the intricacies of financial markets to create a more efficient, transparent, and secure trading environment. This lifecycle is not just about technology; it's about reshaping the financial landscape itself.

Traditionally, options trading has been marked by complexity market volatility and regional disparities, with nuances between American and European-style options. The article underscores the significance of DeFi in democratizing this space, offering a departure from traditional financial structures.

DeFi protocols, predominantly anchored on the Ethereum blockchain, have emerged as key players in the options trading arena. Platforms such as Lyra, Dopex, Opyn, and Hegic are at the forefront, facilitating decentralized options trading with millions of dollars in total value locked. This shift towards decentralized derivatives applications signals a departure from traditional financial intermediaries, as DeFi operates on principles of transparency, accessibility, and heightened security.

By leveraging smart contracts, DeFi not only enhances transactional efficiency but also dismantles traditional entry barriers. This paradigm shift offers users unparalleled control over their assets and personal information, fostering a transparent environment.